SolarTech by HelioBuilders & HelioBuilders

Solar Financing Options

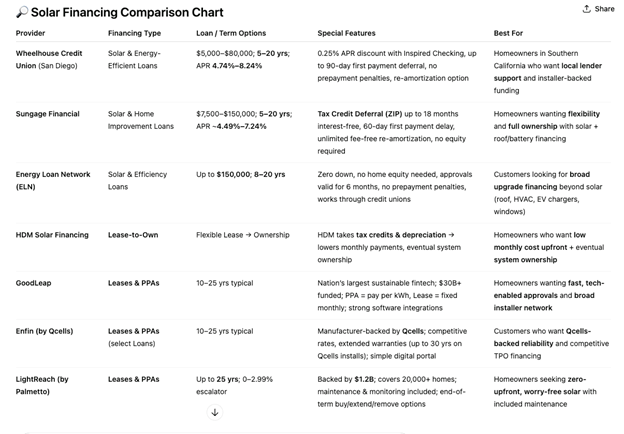

Make the switch to solar simple and affordable with our flexible financing partners. Choose from leases, PPAs, loans, and HELOCs with competitive rates and no upfront costs.

Our Financing Partners

We work with trusted financing partners to offer you the best solar financing options

Financing Partners

Enfin Solar Financing

Enfin Solar Financing makes the switch to solar simple and affordable with flexible Power Purchase Agreements (PPAs) and Lease options. As the first financing provider in the U.S. backed by Qcells, one of the world's leading solar manufacturers, Enfin combines competitive pricing with the reliability of top-tier solar technology. Homeowners can enjoy immediate savings on their electricity bills with no large upfront costs, predictable monthly payments, and long-term system performance backed by Qcells.

Whether you choose a Lease or a PPA, Enfin's programs are designed to deliver maximum savings with minimal hassle. With straightforward approvals, low barriers to entry, and warranties that give peace of mind, Enfin helps HelioBuilders clients lock in lower energy costs today while building a cleaner, more sustainable tomorrow.

Introducing GoodLeap's Solar Leases & PPAs

GoodLeap empowers homeowners to go solar with flexibility, convenience, and no large upfront costs. Through its suite of Lease and Power Purchase Agreement (PPA) options, GoodLeap allows you to benefit from clean energy with either fixed monthly system payments (Lease) or by paying only for the electricity your solar panels generate (PPA). Backed by robust fintech and sophisticated software platforms, GoodLeap has financed over $30 billion in sustainable home projects across 50 states—making it one of the nation's most trusted solar financiers enfin.com+15Wikipedia+15lp.enerflo.com+15.

By leveraging advanced integration tools like GoodLeap TPO through platforms such as Enerflo, installers can offer a streamlined, predictable financing experience—especially when pairing solar with battery storage GoodLeap+13lp.enerflo.com+13The Wall Street Journal+13. Whether homeowners want consistent monthly savings or the flexibility to pay for power used, GoodLeap delivers an accessible, tech-driven path to renewable energy ownership.

How GoodLeap Meets Different Needs:

| Feature | Benefit to Homeowners |

|---|---|

| Lease | Predictable, fixed monthly payments for the solar system |

| PPA | Pay only for the energy produced—closely tied to usage and savings |

| Fintech-Driven Tools | Seamless application & quoting via platforms like Enerflo |

| Proven Track Record | Over $30 billion in loans funded, across 50 states |

Introducing LightReach by Palmetto

LightReach, offered through Palmetto, delivers straightforward, cost-effective solar financing with zero upfront investment. Through its Residential Third-Party Ownership (TPO) plans—including Leases and Power Purchase Agreements (PPAs)—LightReach enables homeowners to access solar energy with a single predictable monthly payment while Palmetto takes care of the rest—system ownership, installation, proactive maintenance, and long-term monitoring. Reddit+9Palmetto+9Solargraf |+9

Backed by over $1.2 billion in capital, LightReach is already powering clean energy adoption across more than 20,000 households in 30+ states, providing reliable solar savings from day one. Solar Builder Magazine+1

Powered by advanced AI technology and integrated design tools, LightReach offers fast, seamless approval and installation—plus long-term stability with customizable escalator rates (as low as 0% to 2.99%) locked in for up to 25 years. Solargraf |+10OpenSolar+10gosolo.io+10

What Sets LightReach Apart:

| Feature | Benefit |

|---|---|

| No Upfront Cost & Maintenance Included | Eliminates financial and operational barriers for homeowners. OpenSolar+8Palmetto+8Palmetto+8 |

| Predictable Monthly Payments | Fixed payments, often lower than utility bills, with customizable escalator rates over 25 years. gosolo.ioPalmetto |

| Robust Financial Backing & Scale | Backed by $1.2 billion in funding; serving 20,000+ homes across 30 states. Solar Builder MagazineClimate Insider |

| Tech-Enhanced Installer Experience | Instant approvals, streamlined workflows, and integrations with Enact, OpenSolar, Enerflo, and more. OpenSolarENACTlp.enerflo.com |

| End-of-Term Flexibility | At contract end, homeowners can buy the system, extend the agreement, or have it removed—all with options tailored to their goals |

Want to have your cake and eat it to?

Introducing HDM Solar Financing

HDM Solar Financing offers a unique Lease-to-Own program designed for homeowners who want the benefits of solar energy without the large upfront investment. Unlike traditional Leases or PPAs, HDM's structure allows their financing partner to capture the federal tax credit (ITC) and system depreciation, passing those savings directly to the homeowner through lower monthly payments and a built-in pathway to ownership. This innovative model means you can lock in solar savings today while knowing the system will ultimately be yours.

With flexible terms, predictable monthly payments, and ownership at the end of the lease, HDM's Lease-to-Own program combines the affordability of a lease with the long-term value of system ownership. By letting HDM handle the tax credit and depreciation complexities, homeowners enjoy maximum savings with minimal hassle—all while protecting against rising utility rates and adding long-term value to their property.

Sungage Solar Loans

Sungage Solar & Home Improvement Loans

Sungage Solar & Home Improvement Loans offer homeowners a smarter way to invest in solar energy and efficiency upgrades—without the upfront expense. Our loans, issued by Hatch Bank, come with no application fees, no home equity needed, and flexible terms from 5 to 20 years to tailor payments to your lifestyle. sungage.com+4SolarReviews+4Solaris Renewables+4

What sets Sungage apart:

- Zero-interest deferred tax credit—defer approximately 30% of your loan interest-free for up to 18 months. SolarReviews+2Solar Mason+2

- First payment delay—your first loan payment begins 60 days after installation, helping you manage finances more easily. Advanced Energy Systems

- Unlimited, no-cost re-amortizations—after a $2,500 prepayment, adjust your payment plan anytime without penalties. sungage.com+1

- High funding limits—finance up to $150,000, whether you're adding solar panels, a battery, or even replacing your roof. Advanced Energy Systems+4SolarReviews+4sungage.com+4

- Consumer-first service—fast online approval, dedicated homeowner support, and seamless coordination with your HelioBuilders installer. sungage.com+8sungage.com+8sungage.com+8

Why choose Sungage?

With affordable, flexible, and transparent solar loans, you get clean energy and modern upgrades with manageable payments and full ownership. Go solar with peace of mind—and real savings—today.

Introducing Energy Loan Network (ELN)

Energy Loan Network (ELN), a subsidiary of Forbright Bank, partners with credit unions and specialist lenders to deliver affordable consumer financing for residential solar and a full suite of energy-efficient home improvements. From solar panels and battery storage to EV chargers, roofing, HVAC, windows, doors, and more, ELN’s flexible loan options—up to $150,000—make going green accessible for homeowners.SolarReviews+11Energy Loan Network+11Energy Loan Network+11

Energy Loan Network (ELN) simplifies solar and energy-efficient upgrades with flexible home improvement loans backed by top lenders and credit unions. Featuring zero down, no home equity needed, and funding up to $150,000, ELN enables HelioBuilders customers to finance panels, batteries, EV charging, HVAC, roofing, and more—all with just one easy application. OpenSolar+10Energy Loan Network+10Energy Loan Network+10

Highlights include:

- Loan Terms: 8–20 years to align with most budgets. OpenSolar+2Solar Installer California+2

- Interest Rates from ~4.99%, depending on credit and lender. OpenSolarSolarReviews

- No Prepayment Penalties—freedom to pay off early without fees. Solar Installer California

- Approvals Good for 6 Months—plenty of flexibility to close your project. Energy Loan Network+4Energy Loan Network+4Forbright Bank+4

- Broad Accessibility—qualify with FICO ~650+, DTI up to 50%, and NO equity requirement. Energy Loan Network+1

- Highly Rated & Trusted—A+ BBB, glowing reviews, and low monthly payments. Solar Installer California+4SolarReviews+4Energy Loan Network+4

Why choose ELN?

Because it's a trusted, all-in-one financing partner that simplifies solar and efficiency projects with affordability, flexibility, and transparency—letting you invest in clean energy with peace of mind.

Introducing:

Wheelhouse Credit Union – Solar & Energy-Efficient Loans

Wheelhouse Credit Union – Solar & Energy-Efficient Loans offer San Diego homeowners flexible and affordable financing for solar energy and efficiency upgrades. Loan amounts of up to $80,000, terms from 5 to 20 years, and competitive APRs starting at 4.74% help make clean energy a reality today. Wheelhouse Credit Union

What sets Wheelhouse apart:

- Up to 90 day first payment deferral to let your solar savings kick in before you start repaying.

- 0.25% APR discount when you pair the loan with an Inspired Checking account and automatic payments. Wheelhouse Credit Union+6Wheelhouse Credit Union+6Wheelhouse Credit Union+6

- No prepayment penalties and the ability to re-amortize after a principal reduction. Wheelhouse Credit Union

- Trusted local partnership: accessible to Southern California customers and working with 100+ installers for smooth financing flow. Wheelhouse Credit UnionReddit

Introducing Figure Home Equity Line of Credit (HELOC)

Figure's HELOC offers homeowners a smart, high-limit way to tap home equity for solar and other home improvement projects. With fixed rates for each draw, rapid approvals, and up to $750,000 accessible—all managed entirely online—it delivers the flexibility and power needed to finance major upgrades seamlessly. Figure+2Figure+2

Key Features & Available Terms

| Feature | Description |

|---|---|

| Borrowing Range | From $15,000 up to $750,000 depending on home equity and credit profile. Figure+1 |

| Fixed-Rate HELOC | Each draw locks in its own fixed rate, eliminating worry about rising variable rates. FigureBankrate |

| Loan Terms | Choose repayment periods spanning 5, 10, 15, or 30 years—with draw and repayment phases combined into one seamless term. Figure+1The Mortgage ReportsForbes |

| Fast & Digital | Apply online in about 5 minutes; funding can be available in as few as 5 days, with no in-person appraisal needed. FigureBankrate |

| Fees & Discounts | Origination fees may apply (up to ~4.99%), but there are no maintenance, appraisal, or prepayment penalties. NerdWalletLendEDUBankrateFigure+1 |

| Draw Mechanics | Figure requires an initial draw of 100% of the approved amount, though borrowers may re-draw later as they repay—each subsequent draw locks in a new fixed rate. Intuit Credit KarmaRedditBankrate |

| Credit Requirements | Generally, a minimum credit score of 640 is needed (higher for investment properties), and the maximum loan amount varies with your credit tier. |

Ready to Go Solar?

Get a free solar quote and explore your financing options today. Our team will help you find the perfect financing solution for your needs.